Summary of "The Intelligent Investor" by Benjamin Graham

"The Intelligent Investor" is a highly regarded investment book written by Benjamin Graham, often referred to as the "father of value investing." First published in 1949, it has since become a classic and a staple for investors seeking guidance on how to approach the stock market. Here is a summary of the book's key points:

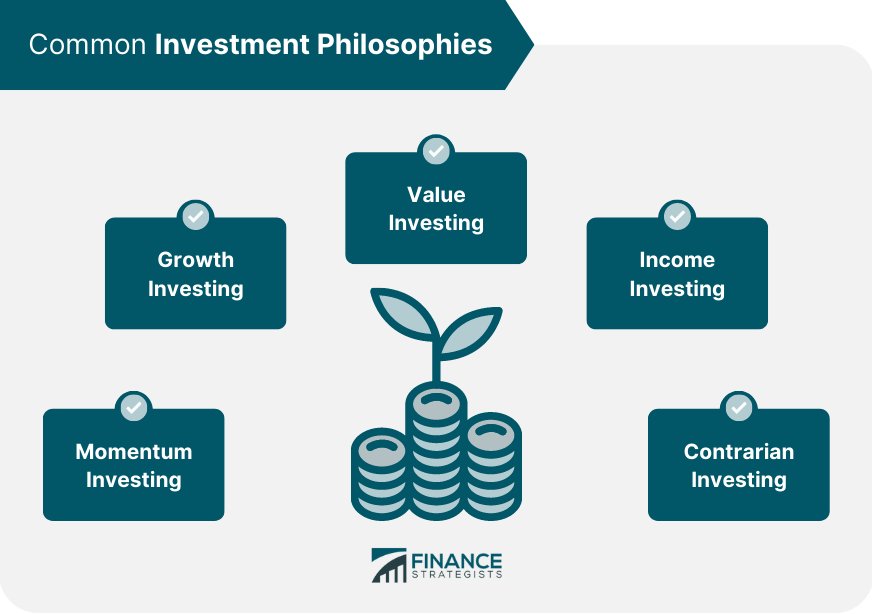

1. Value Investing: Graham emphasizes the importance of value investing, which involves analyzing stocks based on their intrinsic value rather than short-term market fluctuations. He encourages investors to seek out undervalued stocks and adopt a long-term perspective.

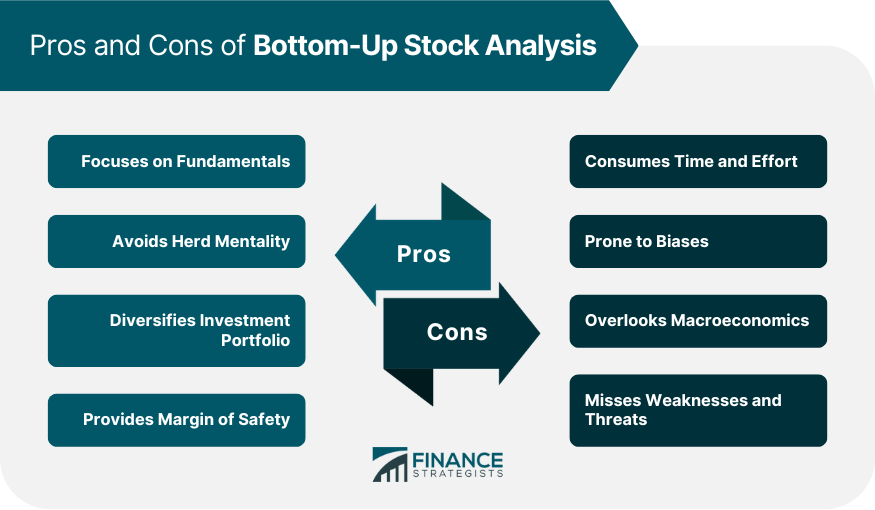

2. Margin of Safety: One of the central concepts in Graham's approach is the margin of safety. This means buying stocks at a price significantly below their intrinsic value, providing a cushion against potential losses. It involves careful analysis and conservative estimates of a stock's worth.

3. Mr. Market: Graham introduces the analogy of Mr. Market to illustrate the stock market's unpredictable nature. He advises investors to take advantage of Mr. Market's emotional behavior by being patient and buying when prices are low, and selling when they are high.

4. Defensive Investing: Graham advocates for defensive investing, focusing on minimizing risk rather than chasing high returns. He suggests diversifying investments across different asset classes, holding a mix of stocks and bonds, and avoiding speculative investments.

5. Intelligent Investor Mindset: Graham stresses the importance of having the right mindset as an investor. He encourages investors to be rational, disciplined, and patient, rather than succumbing to market trends or making impulsive decisions.

6. Fundamental Analysis: The book emphasizes the significance of fundamental analysis in assessing the value of a company. Graham suggests evaluating a company's financial statements, analyzing its earnings, assets, and liabilities, and examining its long-term prospects.

7. Market Fluctuations: Graham acknowledges the inevitability of market fluctuations and advises investors to expect and accept them. He suggests that investors should not let short-term market movements dictate their investment decisions but instead focus on long-term trends.

8. Investor vs. Speculator: Graham distinguishes between investors and speculators. Investors seek to generate long-term wealth by analyzing and investing in undervalued companies, while speculators try to profit from short-term market movements without much regard for a company's fundamentals.

9. Emotional Control: Graham emphasizes the importance of emotional control and discipline in investing. He cautions against being swayed by market sentiment or acting on fear and greed, as these can lead to poor investment decisions.

10. Active vs. Passive Investing: While Graham acknowledges the potential benefits of active investing for skilled investors, he also recognizes the difficulty of consistently outperforming the market. He suggests that for most investors, a passive investment approach through low-cost index funds is a viable and effective strategy.

"The Intelligent Investor" provides a comprehensive framework for approaching the stock market, focusing on the principles of value investing, fundamental analysis, and long-term thinking. By emphasizing the importance of rationality, discipline, and a margin of safety, Graham guides readers toward becoming intelligent investors capable of making sound investment decisions.

Comments

Post a Comment