The 10 to 50 Investing rule 😲

The stock market is a complex and dynamic system that has been around for centuries. It has provided investors with a reliable means of growing their wealth over time. One of the primary benefits of investing in the stock market is the potential for long-term returns. In this blog, we will take a closer look at the 50-year return of the stock market and explore how long investors should keep their money invested before withdrawing.

50-Year Return of the Stock Market:

Over the past 50 years, the stock market has been one of the most reliable ways to grow your money. The S&P 500, which is a benchmark index of 500 large-cap companies in the US, has had an average annual return of 10.72% from 1971 to 2021.

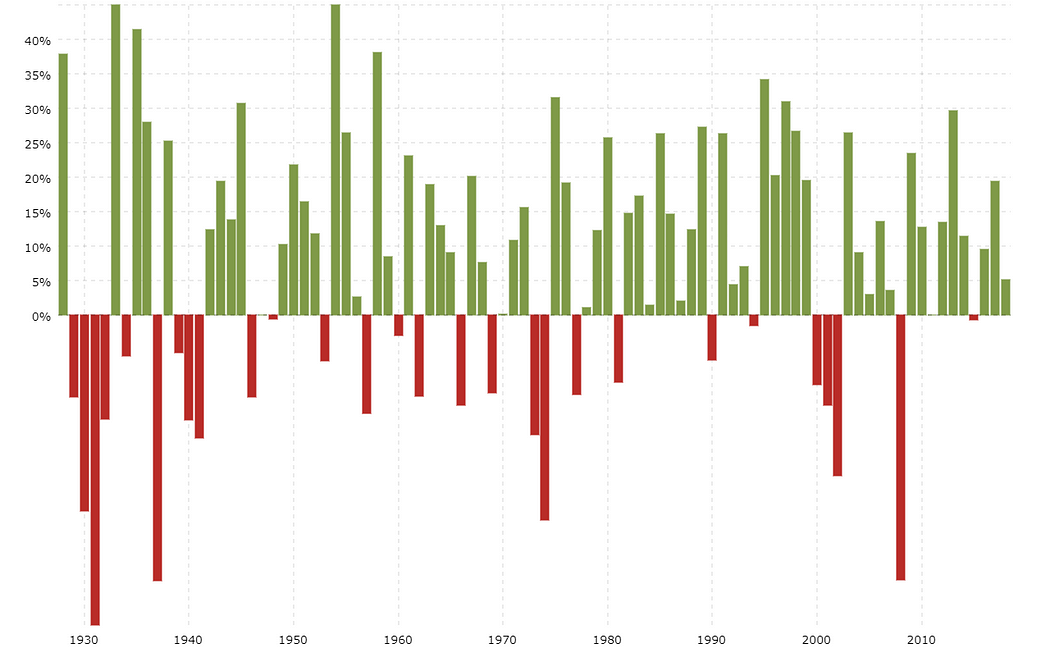

Here is a chart that shows the S&P 500 returns for each year from 1971 to 2021:

As you can see, the stock market has had some ups and downs over the past 50 years. There have been years where the market has returned over 30% and years where it has lost over 30%. However, over the long term, the stock market has provided investors with consistent returns.

How Long Should You Keep Your Money Invested?

When it comes to investing in the stock market, one of the most important things to keep in mind is that it is a long-term game. If you want to maximize your returns, you should be prepared to keep your money invested for a long time.

There are a few reasons why long-term investing is important. Firstly, the stock market can be unpredictable in the short term. There are years where the market goes up and down, and it can be hard to predict when those swings will happen. However, over the long term, the stock market has historically gone up.

Secondly, by keeping your money invested for a long time, you can take advantage of the power of compounding. When you reinvest your dividends or capital gains, you are effectively earning a return on your return. Over time, this can lead to significant gains.

So, how long should you keep your money invested? There is no one-size-fits-all answer to this question. However, as a general rule, most financial advisors recommend that investors keep their money invested for at least five years. This gives your investments time to grow and helps to reduce the impact of short-term market fluctuations.

Conclusion:

The stock market has provided investors with consistent returns over the past 50 years. However, to take advantage of those returns, investors need to be prepared to keep their money invested for a long time. By doing so, you can maximize your returns and take advantage of the power of compounding. Remember, the stock market can be unpredictable in the short term, but over the long term, it has historically gone up. If you want to build long-term wealth, the stock market is a great place to start.

Comments

Post a Comment